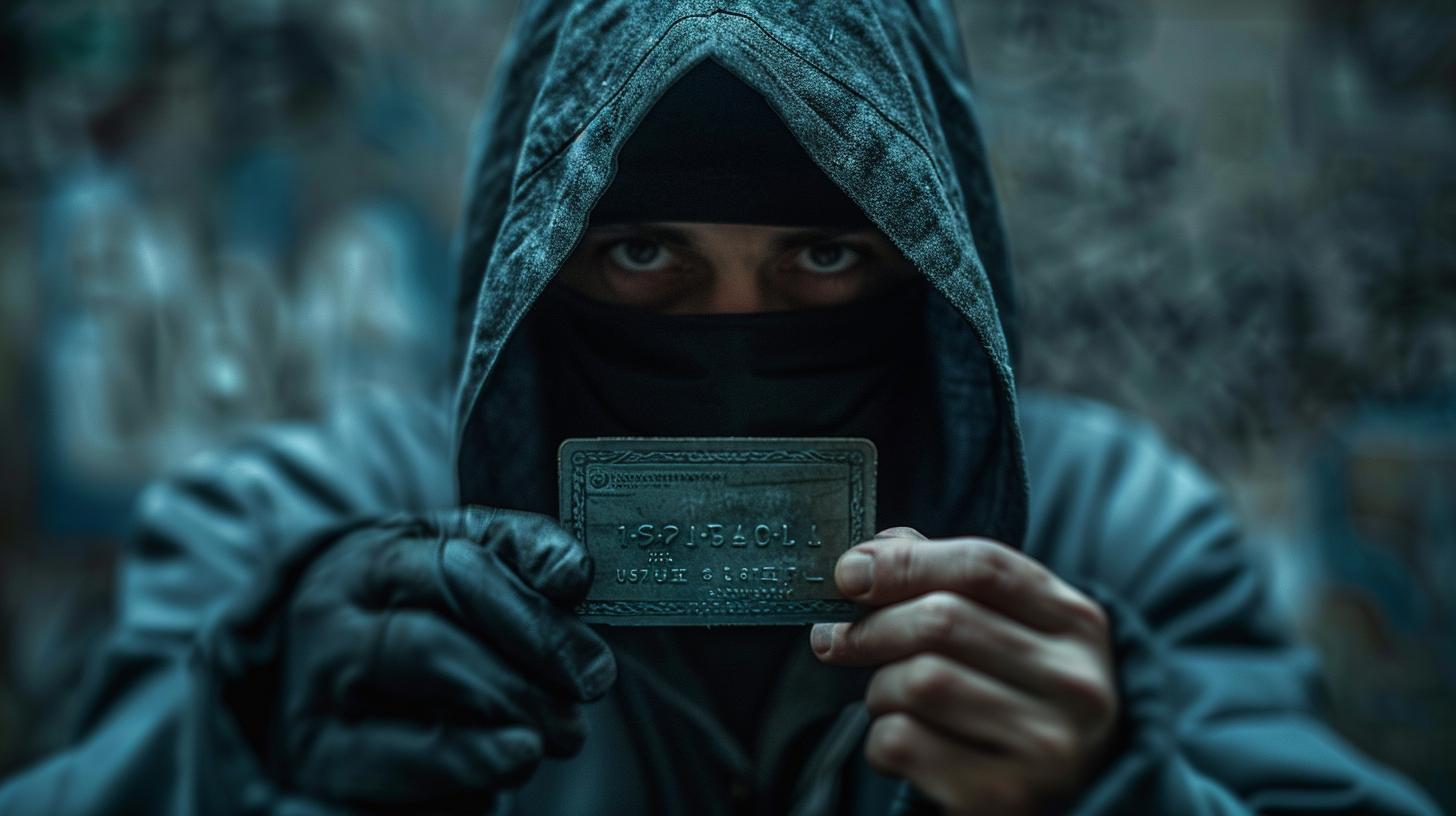

Identity theft is a prevalent form of white-collar crime involving the fraudulent use of personal information for financial gain. This type of fraud thrives in both physical and online environments, posing a significant threat to individuals and businesses alike.

Federal laws have been enacted to combat identity theft, but the problem continues to grow, highlighting the need for stronger preventative measures.

Understanding White Collar Crimes

White-collar crimes are non-violent offenses committed by individuals or organizations for financial gain through deceit or fraud. These crimes are typically sophisticated in nature and are often carried out by individuals in positions of trust or authority.

White-collar crimes can have a significant impact on the economy, as well as on the lives of individuals who fall victim to such offenses.

- White-collar crimes are characterized by their financial motivation and the use of deception to achieve illegal gains.

- These crimes are often complex and require specialized knowledge or skills to execute successfully.

- Individuals involved in white-collar crimes may exploit loopholes in legal or financial systems to carry out their illicit activities.

- White-collar crimes can take many forms, including securities fraud, insider trading, embezzlement, and identity theft.

Understanding the nature of white-collar crimes is crucial for developing effective strategies to prevent and combat these offenses.

By educating the public about the tactics used by perpetrators and the consequences of such actions, we can work towards a society that is better equipped to identify and prosecute white-collar criminals.

Financial Fraud and Identity Theft

Financial fraud is a prevalent form of white-collar crime that encompasses various illegal activities. Identity theft, a particularly damaging type of financial fraud, involves the misuse of someone else’s personal information for fraudulent purposes.

This can lead to severe financial consequences for the victim, as well as emotional distress and reputational harm.

Identity thieves often target sensitive information such as social security numbers, credit card details, and bank account information.

Once obtained, this information can be used to open fraudulent accounts, make unauthorized purchases, or even commit tax fraud. The impact of identity theft on victims can be long-lasting and difficult to recover from, highlighting the importance of vigilance and proactive measures to prevent such crimes.

- Common Types of Financial Fraud:

- Credit card fraud

- Bank fraud

- Insurance fraud

- Investment fraud

- Money laundering

Identity theft is a constantly evolving threat, with cybercriminals utilizing advanced technologies to access personal information without detection.

It is essential for individuals to safeguard their personal data through secure passwords, encrypted connections, and awareness of phishing attempts. By staying informed and implementing best practices for online security, individuals can reduce their risk of falling victim to financial fraud and identity theft.

Federal Laws Against Identity Theft

Identity theft is a serious offense under federal law, with various statutes in place to combat this crime. The most notable law criminalizing identity theft in the United States is the Identity Theft and Assumption Deterrence Act of 1998.

This law makes it a federal crime to knowingly transfer or use the identity of another person with the intent to commit, aid, or abet any unlawful activity.

Penalties for Identity Theft

- Violators of federal identity theft laws face significant penalties, including fines, imprisonment, or both.

The severity of the punishment typically depends on the amount of harm caused to the victim, the number of victims affected, and the offender’s criminal history.

The Role of Law Enforcement

- Federal law enforcement agencies, such as the Federal Bureau of Investigation (FBI) and the United States Secret Service, play a crucial role in investigating and prosecuting identity theft cases.

These agencies work in collaboration with state and local law enforcement to track down and apprehend offenders.

Additionally, the USA PATRIOT Act of 2001 expanded the scope of identity theft laws by addressing terrorist financing and money laundering activities.

This act provides law enforcement agencies with enhanced tools to combat identity theft and related financial crimes.

Protecting Yourself from Identity Theft

Protecting yourself from identity theft is crucial in today’s digital age. There are several proactive steps you can take to safeguard your personal information and financial assets.

- Regularly monitor your financial accounts and credit reports to detect any unauthorized activity.

- Avoid sharing sensitive information, such as your Social Security number or passwords, with unauthorized individuals or websites.

- Use strong, unique passwords for all your online accounts and consider enabling two-factor authentication for an extra layer of security.

- Be cautious when sharing personal information online or over the phone, especially if you’re unsure of the legitimacy of the recipient.

By staying vigilant and taking preventive measures, you can minimize the risk of falling victim to identity theft and protect yourself from financial harm.

The Growing Threat of Identity Theft in the United States

Identity theft poses an ever-increasing threat to individuals and businesses across the United States. With the advancement of technology, the methods used by identity thieves have become more sophisticated, making it easier for them to access personal information and commit fraudulent activities.

The impact of identity theft extends far beyond financial losses, often resulting in emotional distress and long-lasting damage to one’s reputation.

- Identity theft can occur through various channels, including online platforms, the mail system, and even through data breaches in organizations storing sensitive information.

- As the prevalence of identity theft continues to rise, it is essential for individuals to remain vigilant and take proactive measures to safeguard their personal data.

- Being aware of common tactics used by identity thieves, such as phishing scams and malware attacks, can help individuals protect themselves from falling victim to these types of fraudulent activities.

Resources for Victims of Identity Theft

For individuals who have fallen victim to identity theft, there are resources available to help mitigate the damage caused by these crimes.

Victims can seek assistance from organizations specializing in identity theft recovery, providing support and guidance throughout the recovery process.

Victims should report the crime to the Federal Trade Commission (FTC) and their local law enforcement agency.

The FTC offers a comprehensive recovery plan that includes steps to follow and forms to fill out to rectify the situation. Victims can also place fraud alerts on their credit reports and freeze their credit to prevent further fraudulent activity.

- Contact your financial institutions to inform them of the situation, and request new account numbers or cards if necessary.

- Monitor your accounts regularly for any unusual activity, and report any suspicious transactions immediately.

- Consider enrolling in a credit monitoring service to track changes to your credit report and receive alerts of potential fraud.

Penalties for Committing Identity Theft in the United States

Identity theft is a serious crime with severe consequences in the United States.

Individuals convicted of committing identity theft can face significant penalties under both federal and state laws. These penalties are designed to deter future crimes and hold perpetrators accountable for their actions.

- Individuals convicted of identity theft may face imprisonment for a substantial period.

- Fines are also a common penalty for those found guilty of identity theft.

- Restitution may be required to compensate victims for the financial losses they have incurred.

- Probation is another potential penalty, which may include specific conditions such as regular check-ins with a probation officer.

It is essential for individuals to understand the potential penalties for committing identity theft and to recognize the serious nature of this crime.

By adhering to the law and respecting the privacy and financial security of others, individuals can help prevent identity theft and contribute to a safer society for all.

The Impact of Identity Theft on Victims

Identity theft can have severe repercussions for its victims, extending far beyond just financial losses.

Victims often experience significant emotional distress, anxiety, and a sense of violation upon discovering that their personal information has been compromised. The process of recovering from identity theft can be lengthy and arduous, requiring victims to navigate various bureaucratic procedures and work closely with financial institutions and credit agencies to restore their credit.

- Emotional Distress: Victims of identity theft commonly report feeling a profound sense of invasion of their privacy and security. The emotional toll of being a victim of this crime can be overwhelming, leading to increased stress and anxiety.

- Financial Burden: The financial consequences of identity theft can be substantial, with victims facing damaged credit scores, fraudulent debts, and potential legal fees associated with resolving the issue.

- Legal Challenges: Resolving cases of identity theft may also involve legal challenges, as victims may need to prove their innocence and assert their rights in the face of fraudulent activity carried out in their name.

Overall, the impact of identity theft on victims is multifaceted, affecting their emotional well-being, financial stability, and sense of security in profound ways.

Identity Theft Prevention Tips

Protecting yourself from identity theft is essential in today’s digital age. Here are some tips to help safeguard your personal information:

- Be cautious with your personal information, especially online.

- Use strong, unique passwords for each of your accounts.

- Avoid sharing personal details on social media platforms.

- Regularly monitor your financial statements for any unusual activity.

Additionally, consider utilizing identity theft protection services to add an extra layer of security.

The Role of Technology in Identity Theft

Technology plays a crucial role in the perpetration of identity theft. Cybercriminals leverage advanced technological tools to access and exploit personal information for fraudulent activities without the need for physical contact.

With the proliferation of digital platforms and the increasing interconnectedness of systems, the vulnerability to identity theft has only heightened over time.

- Phishing emails and deceptive websites are common tactics used by cybercriminals to trick individuals into divulging sensitive information such as login credentials or financial data.

- Malware and spyware programs are designed to infiltrate computer systems and extract personal information without the user’s knowledge, posing a significant threat to online privacy and security.

- Data breaches, resulting from security vulnerabilities in organizational databases, expose large volumes of personal data to unauthorized parties, enabling identity thieves to steal information on a massive scale.

Advancements in technology have also facilitated the creation of sophisticated identity theft schemes, including synthetic identity fraud, where criminals combine real and fabricated information to create false identities for fraudulent purposes.

The increasing reliance on digital transactions and online services further expands the avenues through which identity theft can occur, emphasizing the critical need for robust cybersecurity measures and heightened awareness among individuals and organizations alike.

.